When getting quotes from companies who thrive on user friendly online insurance applications with no agent interaction, there are a number of important coverages that are left out because they are not required by the state. One coverage that I have seen left out on many of these policies is the Medical Payments Coverage.

In Indiana, my resident state, the minimum requirement for auto insurance is $25,000 per person of bodily injury coverage, $50,000 per accident of bodily injury coverage, and $10,000 per accident of property damage coverage....No other coverage is required by the state. This poses a problem for many reasons, and I'll name a few:

1. Companies who don't care about whether or not you are liable for the damages your policy doesn't cover will provide you with state minimum coverage, leaving you extremely vulnerable to lawsuits!

2. Customers are unaware of what coverages are out there and how important they are to the policyholder or driver when an accident occurs. There are companies out there that won't stress the importance of these coverages enough because they want to be the cheapest company so you will buy their policy and not be concerned about missing out on coverages..just to save some money.

Today, I will be going over Medical Payments coverage. The coverage that provides from $1,000 to $100,000 of coverage for medical bills depending on the amount of coverage you choose.

Who does medical payments coverage cover? Everyone in or on your car!

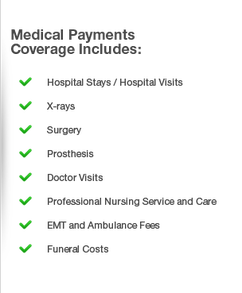

What does this coverage pay for? See the picture above^^^...This coverage provides monies to the passengers to pay for those injury/death expenses resulting from an accident.

What happens when this coverage isn't on a policy? Well, your passengers are left to rely on their health insurance coverage. If your passengers don't have accident plans, then they will be relying on the other driver's insurance company (ONLY IF THE OTHER DRIVER IS AT FAULT) to pay for their medical bills. And if that driver is not at fault, you are left to sue your friend who was driving the car! Now, who wants to be put in that position?

Let me give you an example of this. You are driving down the road in your Chevy Impala...You are getting close to a yellow light getting ready to make a left turn....a car across the intersection is trying to make a quick right turn (he has the right of way) you crash into their vehicle going roughly 35 miles per hour, causing a T collision (Drivers side impact). Two Passengers in your car are jarred around and two of them suffer injuries that need immediate care and are rushed to the hospital. The injuries result in $5,000 in medical bills for each of them (hospital fees, Dr. visits, placement of broken bones, rehab, etc.). That $5,000 per person can be covered by your insurance policy, so that your friends in the car are free from any added stress due to the cost of their injuries.

Always remember that any mistake you make while driving that causes an accident is a liability on your part, whether it is the car you hit or the passengers in your own vehicle....you are held responsible.

These issues are very important to me. We always have real life examples that we are able to show our clients but these are things I cannot discuss through this forum. Please, feel free to contact me if you would like to meet or talk by phone or email and I would be happy to assist you with any questions you might have. Visit the Contact Page and fill out the contact info and I'll reply to you as soon as possible. Thank you for taking the time time to read this blog.

Sincerely,

Jonathan Rolón

Personal Lines Specialist

Acosta Insurance Agency, Inc.

In Indiana, my resident state, the minimum requirement for auto insurance is $25,000 per person of bodily injury coverage, $50,000 per accident of bodily injury coverage, and $10,000 per accident of property damage coverage....No other coverage is required by the state. This poses a problem for many reasons, and I'll name a few:

1. Companies who don't care about whether or not you are liable for the damages your policy doesn't cover will provide you with state minimum coverage, leaving you extremely vulnerable to lawsuits!

2. Customers are unaware of what coverages are out there and how important they are to the policyholder or driver when an accident occurs. There are companies out there that won't stress the importance of these coverages enough because they want to be the cheapest company so you will buy their policy and not be concerned about missing out on coverages..just to save some money.

Today, I will be going over Medical Payments coverage. The coverage that provides from $1,000 to $100,000 of coverage for medical bills depending on the amount of coverage you choose.

Who does medical payments coverage cover? Everyone in or on your car!

What does this coverage pay for? See the picture above^^^...This coverage provides monies to the passengers to pay for those injury/death expenses resulting from an accident.

What happens when this coverage isn't on a policy? Well, your passengers are left to rely on their health insurance coverage. If your passengers don't have accident plans, then they will be relying on the other driver's insurance company (ONLY IF THE OTHER DRIVER IS AT FAULT) to pay for their medical bills. And if that driver is not at fault, you are left to sue your friend who was driving the car! Now, who wants to be put in that position?

Let me give you an example of this. You are driving down the road in your Chevy Impala...You are getting close to a yellow light getting ready to make a left turn....a car across the intersection is trying to make a quick right turn (he has the right of way) you crash into their vehicle going roughly 35 miles per hour, causing a T collision (Drivers side impact). Two Passengers in your car are jarred around and two of them suffer injuries that need immediate care and are rushed to the hospital. The injuries result in $5,000 in medical bills for each of them (hospital fees, Dr. visits, placement of broken bones, rehab, etc.). That $5,000 per person can be covered by your insurance policy, so that your friends in the car are free from any added stress due to the cost of their injuries.

Always remember that any mistake you make while driving that causes an accident is a liability on your part, whether it is the car you hit or the passengers in your own vehicle....you are held responsible.

These issues are very important to me. We always have real life examples that we are able to show our clients but these are things I cannot discuss through this forum. Please, feel free to contact me if you would like to meet or talk by phone or email and I would be happy to assist you with any questions you might have. Visit the Contact Page and fill out the contact info and I'll reply to you as soon as possible. Thank you for taking the time time to read this blog.

Sincerely,

Jonathan Rolón

Personal Lines Specialist

Acosta Insurance Agency, Inc.

RSS Feed

RSS Feed